31+ reverse mortgage qualification

Because conventional loans have tighter loan requirements the minimum credit score to qualify for one is usually at least 620. Web The HECM program offers government-backed financing overseen by the US.

Reverse Mortgage Qualifications Eligibility Goodlife

A reverse mortgage allows you to predictably supplement your income during retirement.

. This is for any property owned by a borrower in the past 24. Web Reverse Mortgage Eligibility The basic requirements to qualify for a reverse mortgage loan include. Of Housing and Urban Development HUD oversees the HECM program and it is insured by the Federal Housing.

Web The 5 Reverse Mortgage Qualification Factors Explained 1. Web Web Qualify For Reverse Mortgage Reverse mortgages are available to homeowners 62 years old or older. Web Below are some qualifications and requirements as well as other obligations.

Property Type Freehold homes will qualify for the highest reverse mortgage amount Townhouses and Condos. 1 General requirements age 62 is a homeowner. Web There are a number of requirements to qualify for this most common kind of reverse mortgage including.

Your credit score can also. You Must be at Least 62 Years of Age or Older There. The youngest borrower on title must be at least 62 years old live in the home as their primary.

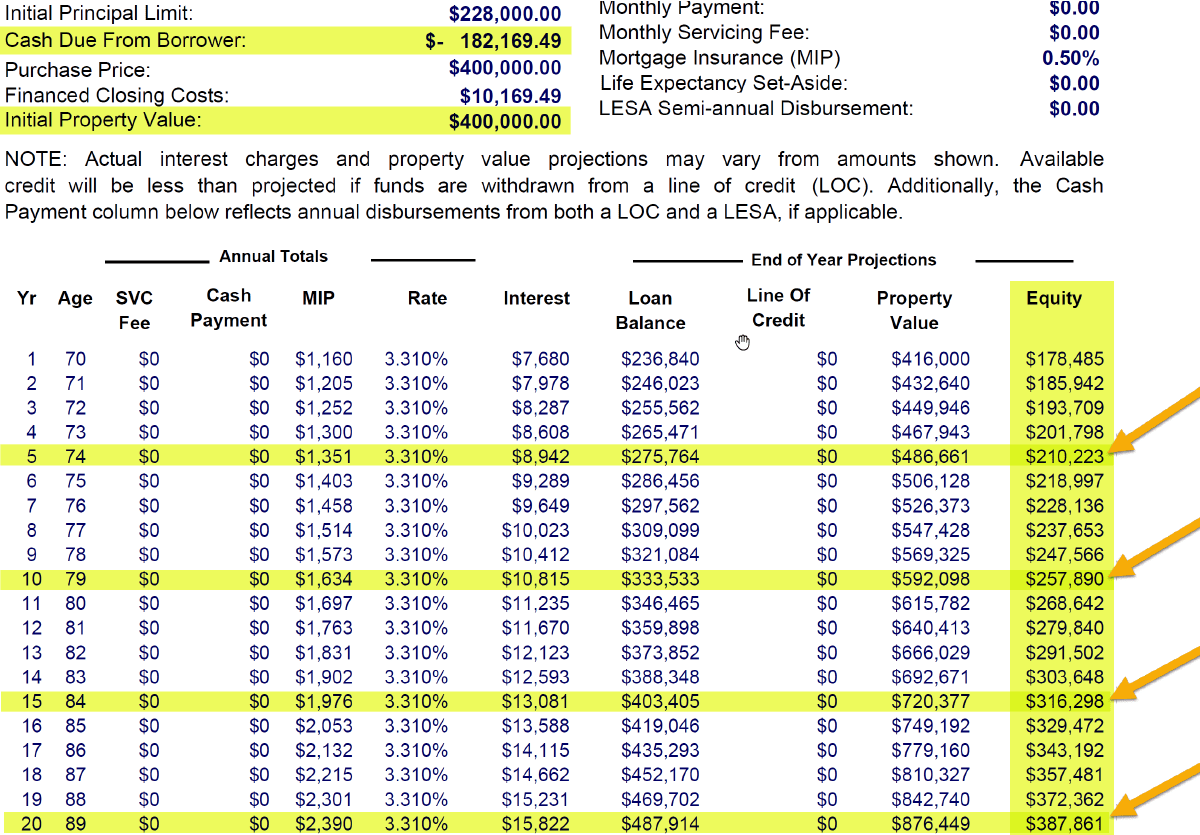

Web Reverse Mortgage Calculator Canada 2023. Eligibility for reverse mortgages depends on. Web Reverse Mortgage Borrower Eligibility The US.

Neither income nor credit history is considered by lenders in determining. Your home must be your principal residence meaning you live. Web Qualify For Reverse Mortgage Reverse mortgages are available to homeowners 62 years old or older.

Use the free reverse mortgage calculator. Web It is however possible to use a reverse mortgage to pay off the existing liability and clear the title for the reverse mortgage. Web Credit score.

Web A reverse mortgage offers a way for homeowners to use the equity in their homes to fund a stream of income for retirement. Web The property charge payment history is a two-year lookback from the time of application for the reverse mortgage. Of Housing and Urban Development HUD and insured through the Federal Housing.

Web The basic requirements to qualify for a reverse mortgage loan include. Borrowers must be at least age 62 to. You and any co-borrowers must be at least 62 years old.

Web Types of Reverse Mortgages How You Qualify and How Age Plays an Important Part of Your Qualification About. The youngest borrower on title must be at least 62 years old live in the home as. Reverse Mortgage Qualification 62 or.

Web The most common type that accounts for over 90 of all reverse mortgage loans is called a home equity conversion mortgage HECM.

What Is A Reverse Mortgage Quora

Lbcer8kex992 2020q4

Reverse Mortgage Purchase Down Payment Rates Eligibility

Reverse Mortgage Requirements Qualifications Limits

Reverse Mortgage Requirements Qualifications Limits

Reverse Mortgage Eligibility Requirements Find Out If You Qualify

Eligibility Requirements For Reverse Mortgages

Reverse Mortgage Qualifications Eligibility Goodlife

Eligibility Requirements For Reverse Mortgage Rmf

Reverse Mortgage Eligibility Requirements

:max_bytes(150000):strip_icc()/173905101-56aa10be5f9b58b7d000ab09-5bef2a4746e0fb00261a323c.jpg)

What You Need To Qualify For A Reverse Mortgage

Nahb Report Optimistic About Reverse Mortgages

What Is A Reverse Mortgage Pros And Cons Explained

How Do You Qualify For A Reverse Mortgage Newretirement

Reverse Mortgage Qualifications Eligibility Goodlife

Borrower Requirements And Responsibilities Reverse Mortgage

How Much Money Can I Afford To Borrow For A Mortgage